Bold Vision. Extraordinary Results.

Simple & Transparent Funding Process

Understand Your Requirement

Share your business details and funding needs with our team.

Financial Assessment

Our experts evaluate your profile and identify the best financing options.

Documentation & Approval

We assist with documentation and ensure fast approval through our lending partners.

Fund Disbursement

Approved funds are directly credited to your bank account.

You’ll Always Know What to Do Next. .

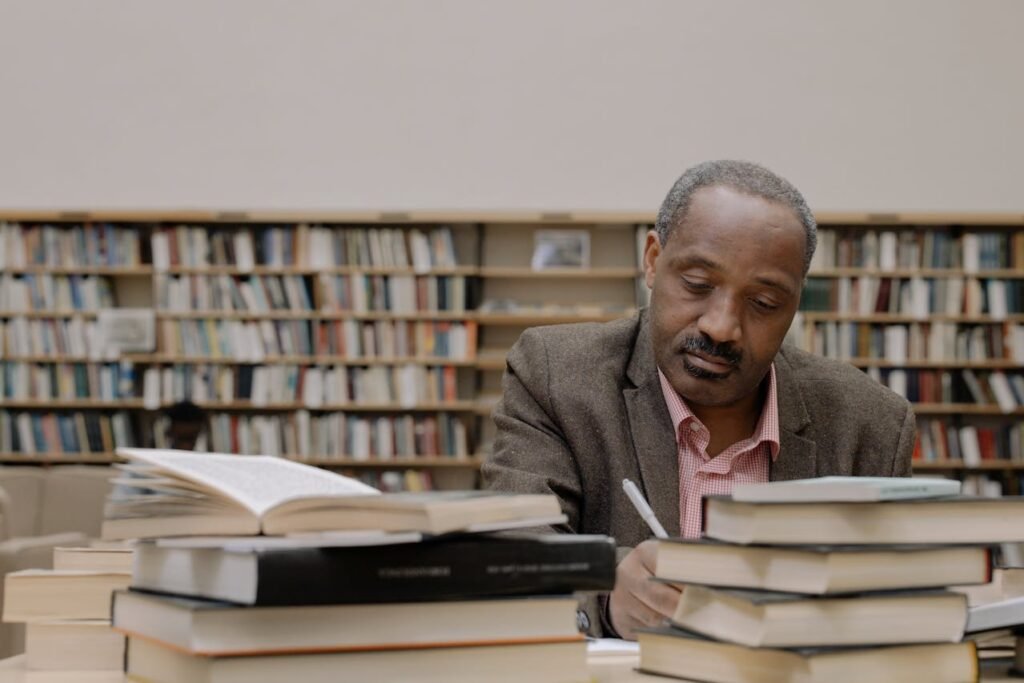

Choosing The Right

Financial Planning Team

Real Client Experiences That Speak for Themselves

“Gigoria made managing my business finances incredibly simple. From consultations to execution, everything was structured and transparent. Their guidance helped me make confident financial decisions.”

“As a startup, we needed clarity and speed. Gigoria provided both. Their financial insights and planning support saved us time and helped us scale with confidence.”

“I’ve worked with multiple finance platforms, but Gigoria stands out for its efficiency and reliability. A trustworthy partner for businesses looking for smart financial solutions.”

Business Finance

Blog – Direct from Gigoria Experts

Frequently Asked Questions (FAQs)

Common questions on financial planning and investing

What is Gigoria?

Gigoria is a business finance consulting platform that helps startups, SMEs, and enterprises access the right financial solutions. We provide expert guidance and connect businesses with trusted lenders to secure funding efficiently.

What types of business loans does Gigoria offer?

We assist with a wide range of financial solutions, including:

Business Loans

MSME / SME Loans

Working Capital Finance

Startup Funding

Loan Against Property

Balance Transfer

Financial Advisory Services

Who can apply for a business loan through Gigoria?

Any business entity including:

Proprietorships

Partnerships

Private Limited Companies

LLPs

Startups and MSMEs

Eligibility depends on business stability, financial records, and lender criteria.

What documents are required to apply?

Commonly required documents include:

KYC documents

Business registration proof

Bank statements

Financial statements / ITR

GST returns (if applicable)

Our team assists you throughout the documentation process.

Can startups apply for funding even if they are new?

Yes. We support startups at various stages and help them explore suitable funding options based on their business model, projections, and growth potential.